A new era of financial innovation has been brought about by the rapid expansion of cryptocurrency trading, and one notable development is the auto crypto trading app. These apps are revolutionizing how traders, regardless of skill level, approach the erratic cryptocurrency market. This blog explores the definition, operation, and growing importance of auto cryptocurrency trading apps for cryptocurrency enthusiasts.

What are Auto Crypto Trading Apps

An auto crypto trading app is a software application designed to execute cryptocurrency trades automatically on behalf of the user. These apps utilize algorithms and predefined strategies to buy and sell cryptocurrencies without the need for manual intervention. The primary aim is to maximize profits and minimize losses by taking advantage of market opportunities in real time.

How Auto Crypto Trading Apps Work

Auto crypto trading apps function through a combination of algorithmic trading and sophisticated software development. Here’s a breakdown of the key components and processes involved:

- Algorithmic Trading: At the heart of any auto crypto trading app is an algorithm. These algorithms are programmed with specific trading strategies that dictate when to enter and exit trades. They can be based on various technical indicators, historical data, and market analysis.

- Market Analysis: The app continuously monitors the crypto market, analyzing vast amounts of data to identify potential trading opportunities. This can include tracking price movements, trading volumes, and news events that might impact the market.

- Execution: Once a trading opportunity is identified, the app executes the trade automatically. This is done without any delay, ensuring that trades are executed at the most optimal prices.

- Risk Management: Effective auto crypto trading software includes powerful risk management features. This can involve setting stop-loss and take-profit levels, adjusting trading volumes, and diversifying across different cryptocurrencies to mitigate risk.

Advantages of Using Auto Crypto Trading Apps

The popularity of auto crypto trading apps can be attributed to several key advantages:

- 24/7 Trading: Unlike traditional markets, the cryptocurrency market operates 24/7. Automated crypto trading allows users to capitalize on opportunities around the clock without the need for constant monitoring.

- Emotion-Free Trading: Human emotions can often lead to poor trading decisions. Automated trading bots eliminate emotional bias, ensuring trades are executed based on logic and strategy.

- Efficiency and Speed: Compared to human traders, automated trading bots can evaluate data and make transactions far more quickly. This speed is crucial in the fast-paced world of crypto trading.

- Backtesting and Optimization: Many auto crypto trading apps allow users to back test their strategies against historical data. This helps refine and optimize trading strategies for better performance.

Key Features of Auto Crypto Trading Software

To make the most of automated crypto trading, it’s important to understand the key features that high-quality auto crypto trading software should offer:

- Customizable Strategies: Users should be able to create and customize their trading strategies based on various indicators and conditions.

- User-Friendly Interface: The software should be easy to navigate, even for those who are new to crypto trading.

- Backtesting: The ability to test strategies against historical data is crucial for understanding their potential performance.

- Real-Time Market Data: Access to real-time market data ensures that trading decisions are based on the most current information.

- Security: Powerful security measures, including two-factor authentication and encryption, are essential to protect user data and funds.

- Integration with Exchanges: The software should support integration with multiple exchanges to provide users with a wide range of trading opportunities.

The Role of Automated Trading Bots

Automated trading bots are the engines that drive auto crypto trading apps. These bots can be programmed to execute a variety of trading strategies, from simple market orders to complex arbitrage opportunities. Here are some common types of automated trading bots:

- Market-Making Bots: These bots place buy and sell orders at specified intervals to profit from the bid-ask spread. They provide liquidity to the market and can be highly profitable in stable markets.

- Arbitrage Bots: Arbitrage bots take advantage of price discrepancies between different exchanges. They pocket the difference when they buy low on one exchange and sell high on another.

- Trend-Following Bots: These bots analyze market trends and execute trades that align with the current trend. They can be effective in capturing prolonged price movements.

- Mean Reversion Bots: Mean reversion bots assume that prices will revert to their mean or average over time. They buy when prices are low and sell when prices are high relative to the mean.

Challenges and Risks of Automated Crypto Trading

While automated crypto trading offers numerous benefits, it also comes with its own set of challenges and risks:

- Market Volatility: The crypto market is highly volatile, and sudden price movements can lead to significant losses if not managed properly.

- Technical Failures: Like any software, auto crypto trading apps can experience technical glitches or connectivity issues that may result in missed opportunities or unexpected losses.

- Overfitting: Over-optimization of trading strategies based on historical data (overfitting) can lead to poor performance in live trading.

- Security Risks: Storing funds on exchanges and providing API access to trading bots introduces security risks. It’s essential to use platforms with powerful security measures.

Best Practices for Using Auto Crypto Trading Apps

To maximize the benefits and minimize the risks of automated crypto trading, consider the following best practices:

- Start Small: Begin with a small amount of capital to test and refine your strategies without exposing yourself to significant risk.

- Diversify: Spread your investments across different cryptocurrencies and strategies to avoid risk.

- Monitor Performance: Regularly review the performance of your trading bots and make necessary adjustments to improve their effectiveness.

- Stay Informed: Keep up with the latest developments in the crypto market and adjust your strategies accordingly.

- Use Reputable Platforms: Choose a reputed auto crypto trading platform like ours with positive user reviews.

All in One Crypto: The Best Crypto Auto Trading Platform

All in One Crypto is a leading platform for automated cryptocurrency trading, combining advanced features with an easy-to-use interface. Here, you can easily set up your exchange account and configure bots to trade automatically for you.

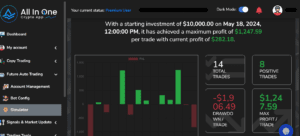

One of the standout features is our Future Auto Trading Simulator. This tool lets you see how our trading bots have performed in the past. Simply select your preferred cryptocurrency exchange, choose a coin, and set a time frame. Then, click the “Check performance” button. You’ll get a detailed report showing the bot’s past 1000 trades, including information like profit and loss, trade accuracy, and the number of successful versus unsuccessful trades.

To try it out 👇

https://dashboard.allinonecrypto.app/auto-trading-futures-bot-config/simulator

This feature-rich platform provides everything you need to make informed trading decisions and offers the resources and support to enhance your trading outcomes significantly, making All in One Crypto the a preferred option for beginner and expert traders alike.

The Future of Automated Crypto Trading

The future of automated crypto trading looks promising, with ongoing advancements in technology and increased adoption by traders worldwide. Some trends to watch for include:

- AI and Machine Learning: The integration of artificial intelligence and machine learning into auto crypto trading apps can enhance their ability to analyze data and make more accurate predictions.

- Regulatory Developments: As the crypto market matures, regulatory frameworks will likely evolve, impacting how automated trading is conducted.

- Increased Accessibility: More user-friendly platforms and educational resources will make automated trading accessible to a broader audience.

- Enhanced Security: Advances in cybersecurity will help protect users’ funds and data, addressing one of the major concerns in automated trading.

Conclusion

Auto crypto trading apps represent a significant leap forward in the world of cryptocurrency trading. By using advanced algorithms and automation, these apps enable traders to capitalize on market opportunities 24/7 without the need for constant monitoring. While there are risks and challenges associated with automated crypto trading, the benefits, such as emotion-free trading and increased efficiency, make it an attractive option for many traders.

To get started with automated crypto trading, it’s essential to choose the right platform, develop a sound trading strategy, and stay informed about market developments. By choosing the best crypto auto trading platform and following best practices and continuously refining your approach, you can use the power of auto crypto trading apps to enhance your trading performance and achieve your financial goals. Whether you’re an all-time trader or a beginner, the future of crypto trading lies in automation and now is the perfect time to explore its potential.

Frequently Asked Questions

Q.1 What is an automated trading bot in the context of crypto trading?

An automated trading bot is a program that executes cryptocurrency trades automatically based on specific algorithms and market analysis. These bots can perform various trading strategies, such as market making, arbitrage, and trend following.

Q.2 Can beginners use auto crypto trading software?

Yes, auto crypto trading software is designed to be user-friendly and accessible to beginners. Platforms like All In One Crypto offer simple interfaces and pre-configured strategies to help new traders get started without extensive knowledge of the market.

Q.3 How does auto crypto trading software work?

Auto crypto trading software works by using algorithms to analyze market data and execute trades automatically. It monitors the market 24/7, identifies trading opportunities, and places trades according to predefined strategies.

Q.4 What are the benefits of using automated crypto trading?

Automated crypto trading offers several benefits, including 24/7 trading, emotion-free decision-making, increased trading speed and efficiency, and the ability to backtest and optimize trading strategies.

Q.5 Can auto crypto trading apps guarantee profits?

No, auto crypto trading apps cannot guarantee profits. While they can execute trades based on sophisticated algorithms, the inherent volatility and unpredictability of the cryptocurrency market mean there is always a risk of loss.