The realm of cryptocurrency has seen exponential growth over the past decade, attracting traders and investors from all corners of the globe. One of the most intriguing advancements in this space is the development of automated trading systems, particularly auto trade crypto signals. These systems use complex algorithms to execute trades on behalf of users, often with remarkable accuracy and efficiency. In this guide, we will discuss the intricacies of these algorithms, exploring how they work, their benefits, and what users should consider when choosing an automated crypto trading platform.

What are Auto Trade Crypto Signals?

Auto trade crypto signals are automated alerts or instructions generated by sophisticated algorithms that suggest when to buy or sell cryptocurrencies. These signals are based on a variety of factors, including market trends, historical data, technical analysis, and sometimes even social media sentiment. The primary aim is to provide traders with actionable insights to maximize their profits while minimizing risks.

The Mechanics Behind Auto Trader Crypto Algorithms

The algorithms powering auto trade crypto signals are designed to analyze vast amounts of data quickly and accurately. Here are the key components and techniques used:

- Technical Analysis: This involves studying historical price charts and trading volumes to identify patterns and trends. Common technical indicators used include Moving Averages (MA), Relative Strength Index (RSI), and Bollinger Bands.

- Fundamental Analysis: While less common in algorithmic trading, some platforms incorporate fundamental analysis, which examines the intrinsic value of an asset based on news, events, and financial statements.

- Machine Learning: Advanced auto trader crypto algorithms often utilize machine learning models to improve their predictive accuracy. These models can learn from past data and adapt to new market conditions.

- Sentiment Analysis: By analyzing social media, news articles, and forums, algorithms can gauge market sentiment and predict potential price movements based on the overall mood of the market.

- Arbitrage Opportunities: Some algorithms are designed to exploit price differences of the same asset across different exchanges. This requires rapid execution and sophisticated risk management strategies.

Benefits of Using Automated Crypto Trading Platforms

Using an Auto Trade Crypto Signals platform offers several advantages:

- Speed and Efficiency: Algorithms can process and analyze data much faster than humans, allowing for quicker decision-making and execution of trades.

- Elimination of Emotional Bias: Emotions often lead to poor trading decisions. Automated systems follow predefined rules, ensuring consistent and objective trading.

- 24/7 Trading: Cryptocurrency markets operate round the clock. Automated systems can monitor and trade continuously without any breaks, capitalizing on opportunities whenever they arise.

- Backtesting: These platforms allow users to test their strategies on historical data to evaluate their effectiveness before deploying them in live trading.

- Diversification: Automated systems can manage multiple trades and strategies simultaneously, enabling better diversification and risk management.

Choosing the Right Automated Crypto Trading Platform

When selecting an Auto Trade Crypto Signals platform, consider the following factors:

- Reputation and Reliability: Research the platform’s track record and read user reviews to ensure it is reputable and reliable.

- Customization and Flexibility: The platform should allow users to customize their trading strategies and parameters according to their risk tolerance and investment goals.

- Security: Ensure the platform uses strong security measures to protect user data and funds.

- Cost: While some platforms offer auto trading for free, others may charge fees. Evaluate the cost structure and ensure it aligns with your budget and expected returns.

- User Interface and Experience: A user-friendly interface is crucial for smooth navigation and efficient trading. Seek for platforms that offer extensive support resources and user-friendly designs.

Combining Real-Time Auto Trade Crypto Signals with Comprehensive Bot Performance Insights : Future Auto Trading Simulator

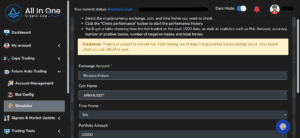

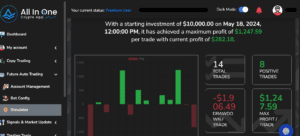

One of the standout features of All In One Crypto is the Future Auto Trading Simulator. This powerful tool lets you see how our trading bots have performed in the past, based on the specific coin and time frame you select. Simply choose your preferred cryptocurrency exchange, select a coin, and set a time frame. Then, click the “Check performance” button to generate a detailed performance history.

The simulator will provide you with a comprehensive table showing how the bot traded over the last 1000 data points. You’ll receive vital statistics, including Profit and Loss (PnL) Amount, trade accuracy, the number of positive and negative trades, and the total number of trades executed.

With these features, All In One Crypto offers everything you need to manage your trading strategies effectively, making it the best choice for crypto auto trading.

Try it out at: 👇

How to Get Started with Automated Crypto Trading

- Educate Yourself: Before diving into automated trading, understand the basics of cryptocurrency markets and trading strategies.

- Choose a Platform: Based on the factors mentioned above, select a suitable automated crypto trading platform.

- Set Up Your Account: Register and complete any necessary verification processes. Make sure two-factor authentication and strong passwords are used to protect your account.

- Configure Your Strategy: Customize your trading strategy, including parameters like entry and exit points, stop-loss limits, and position sizes.

- Backtest Your Strategy: Use historical data to test your strategy’s performance. Make adjustments as needed based on the results.

- Start Trading: Once satisfied with your strategy, deploy it in live trading. Monitor its performance and make tweaks as necessary.

The Future of Auto Trade Crypto Signals

The field of automated crypto trading is continually evolving, driven by advancements in technology and increasing market complexity. Here are some trends and future prospects:

- Integration of AI and Blockchain: The integration of artificial intelligence with blockchain technology could lead to more transparent, efficient, and secure trading systems.

- Improved Machine Learning Models: As machine learning techniques become more sophisticated, algorithms will be able to analyze more complex data sets and make even more accurate predictions.

- Greater Accessibility: As competition among platforms increases, we can expect more user-friendly and affordable solutions, making automated trading accessible to a broader audience.

- Regulatory Developments: As the regulatory landscape for cryptocurrencies evolves, automated trading platforms will need to adapt to ensure compliance, potentially leading to more powerful and trustworthy systems.

- Enhanced Customization: Future platforms will likely offer even greater customization options, allowing users to fine-tune their strategies to an unprecedented degree.

Risks and Considerations

Although automated trading has many advantages, there are also various risks involved. Here are some important considerations:

- Market Volatility: Cryptocurrencies are known for their volatility, which can lead to significant losses if not properly managed.

- Technical Failures: Automated systems are not immune to technical glitches or failures, which can result in missed trades or incorrect executions.

- Over-Optimization: Relying too heavily on backtested data can lead to over-optimized strategies that perform well in historical tests but fail in live markets.

- Security Risks: Storing funds on trading platforms or exchanges exposes users to potential hacks and security breaches.

- Regulatory Risks: Changes in regulations can impact the legality and functionality of automated trading systems.

Best Practices for Automated Trading

- Regular Monitoring: Despite automation, regularly check your algorithms to ensure they are performing as expected and adjust parameters as necessary.

- Risk Management: Use stop-loss and take-profit orders to manage risks. To distribute risk over a variety of assets, diversify your portfolio.

- Stay Informed: Keep up with market news and trends, as significant events can impact the effectiveness of your algorithms.

- Avoid Overfitting: Ensure your strategies are powerful and not overly optimized for historical data, which can lead to poor performance in live markets.

- Continuous Learning: The field of automated trading is constantly evolving. Continuously educate yourself about new algorithms, technologies, and market developments.

Ethical Considerations and Regulations

The rise of automated trading raises several ethical and regulatory issues. It’s important to consider:

- Market Manipulation: Algorithms must be designed to avoid practices that could be considered manipulative, such as pump-and-dump schemes.

- Fairness: Ensure that trading strategies do not exploit unfair advantages, such as latency arbitrage, that may disadvantage other market participants.

- Transparency: Choose platforms like AllInOneCrypto, that operate transparently, providing clear information about how their algorithms work and how user data is protected.

- Regulatory Compliance: Stay informed about the regulatory environment in your region and ensure your trading practices comply with local laws and regulations.

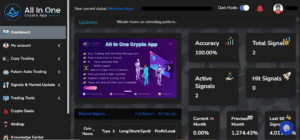

Trade Smarter with All In One Crypto’s Accurate and Reliable Auto Trade Crypto Signals

All In One Crypto App is your ultimate partner for automated cryptocurrency trading, providing various features that offer top-tier Auto Trade Crypto Signals right at your fingertips. As you seek premium trading signals, focusing on accuracy and reliability is very important. We achieve this by sourcing our signals from credible experts and using advanced AI technology to ensure they are both dependable and actionable.

Our Auto Trade Crypto Signals service delivers some of the best Bitcoin signals available in the market. These signals are designed to help you make informed trading decisions quickly and efficiently. Joining our Telegram group connects you with a vibrant and supportive community. Here, you receive instant and efficient trade crypto signals, allowing you to stay ahead of market trends and make timely trades.

We understand that in the fast-paced world of cryptocurrency trading, timing is everything. Our system is designed to send out important Auto Trade Crypto Signals instantly, so you can quickly respond even while on the go, using your mobile device. This immediacy ensures that you never miss a critical trading opportunity.

With All In One Crypto, you gain access to a powerful combination of expert insights, AI-driven Auto Trade Crypto Signals, and a supportive community, making it one of the best options for auto crypto trading. Join us today and take your Bitcoin trading to the next level.

Enjoy the benefits of various crypto tools at your convenience here 👇

Read More: Auto Crypto Trading App And How Does It Work | Crypto Pair Screeners Strategies For Using Effectively

Conclusion

Auto trade crypto signals represent a significant advancement in the world of cryptocurrency trading. By using sophisticated algorithms, traders can benefit from faster, more efficient, and emotion-free trading. However, it is crucial to choose a reliable and secure automated crypto trading platform, understand the underlying mechanisms, and stay aware of the associated risks. As technology continues to evolve, the future of automated trading holds immense potential, promising even more innovative and accessible solutions for traders worldwide.

By staying informed and adopting best practices, users male use of auto trade crypto signals to enhance their trading strategies and achieve their financial goals. Whether you’re an experienced trader or a newcomer to the world of cryptocurrencies, automated trading offers a compelling way to navigate the dynamic and often unpredictable crypto markets.

Frequently Asked Questions

- What are auto trade crypto signals?

Auto trade crypto signals are automated alerts generated by algorithms that provide recommendations on when to buy or sell cryptocurrencies based on market data and analysis.

- How does an auto trader crypto algorithm work?

An auto trader crypto algorithm analyzes market trends, historical data, technical indicators, and sometimes sentiment analysis to generate buy and sell signals, which are then executed automatically on the trading platform.

- Can I use auto trading for free?

Yes, some automated crypto trading platforms offer free basic versions or trials of their services. However, more advanced features and customization options may require a subscription or payment.

- What should I look for in an automated crypto trading platform?

When choosing an automated crypto trading platform, consider factors such as reliability, customization options, security measures, user interface, and cost.

- Are there risks associated with auto trade crypto signals?

Yes, risks include market volatility, technical failures, security breaches, and the possibility of over-optimized strategies that may not perform well in live markets. It’s important to continuously review and modify your strategies.