Margin trading in cryptocurrency is a sophisticated financial technique that people use to invest in cryptocurrencies that involves multiplying risks and potential profits by allowing traders who take loans to have more assets than they can with their own funds alone, thus increasing their trading size. However, if not properly managed, this activity can lead to significant loss. This blog discusses what margin trading is in what it means, explains the risks involved, and suggests effective ways of managing these risks.

What is Margin Trading?

Margin trading is when traders borrow money from either brokers or exchanges, thereby obtaining an amount of capital that will act as a guarantee for the loan. The money received as a result is deemed to be leverage. For example, with leverage of 10:1, a trader can open a position that is ten times larger than their actual capital.

In the context of cryptocurrency, margin trading allows traders to increase their exposure to the market. This implies even small movements in price could generate substantial profits or losses. Margin trading profits can be increased considerably through proper management of trades that become successful. But it equally magnifies losses in case there is an unfavorable move against a trader on the market, turning margin trading into a high-stakes practice. Many people are attracted to margin trading crypto because it promises potentially higher returns but it is important to know how it works and understand its risks before starting.

Differences Between Crypto Leverage and Margin Trading

Crypto leverage and margin trading are interrelated but distinct terms of cryptocurrency trading.

Crypto Leverage stands for the use of borrowed funds in expanding a trader’s exposure to the market, without having to commit a lot of capital upfront. In essence, it increases potential returns from market movements by multiplying them using little margin amounts to open bigger positions.

However, Margin trading is basically borrowing money for the purpose of cryptocurrency trade. A brokerage or an exchange usually provides this loan. As such, you make deposits that become your margins which act as security against which loans are given to facilitate your highly leveraged trades in cryptos. This principle amplifies both possible profits and losses thereby necessitating good risk management skills among traders.

The key difference between the two lies in their application. Leverage specifies the ratio of borrowed funds to the trader’s own investment, while margin trading is the broader practice that includes borrowing the money itself and managing the associated risks like liquidation and variable interest rates.

The Risks in Crypto Margin Trading

Margin trading in cryptocurrency carries several risks due to the volatile nature of digital currencies. Here are some of the critical risks involved:

- Interest Costs: Margin trading is not free and funds borrowed attract interest charges. This can significantly reduce or even wipe out profits if a position is held open for too long.

- Liquidation Risk: Margin trading carries an increasing risk, which is liquidation risk. If the market turns against the trader’s position, the position is liquidated by the broker or exchange to recover borrowed funds. This may result in losing all initial capital invested by the trader himself/herself.

- Market Volatility: Cryptocoins are famous for their volatile nature. Margin can be wiped out through abrupt and significant price movements necessitating liquidation.

- Psychological Pressure: With high stakes in margin trading, there is likely to be stress emotionally which makes it possible for one to decide with impulse. When people are driven by fear and greed, they fail to make the right trading decisions leading to more risk.

- Technical Risks: At times, cryptocurrency exchanges may have technical problems like downtime thereby preventing traders from effectively managing their positions. Besides, security threats such as hacking can lead to loss of funds.

Strategies for Managing Risks in Margin Trading Crypto

Risk management is very important when margin trading. The following are some strategies that traders can employ:

- Small Starts: This is an excellent starting point for beginners in cryptocurrency margin trading to ensure that you understand the process and its risks without suffering huge losses.

- Utilize Stop Loss Orders: These automatically close positions at a set price, thus preventing significant losses. In volatile markets, they are crucial in risk control.

- Watch out for Interest Rates: You should also be aware of the interest rate charged on borrowed funds and how it can affect your trading results. It is necessary to make sure that the potential gains are larger than the costs.

- Keep Sufficient Margins: It is necessary to always ensure that an account has enough funds to avoid margin calls and liquidations. This may include adding funds to a position to cover any possible losses.

- Stay Informed: Updates about market events and trends should be followed closely. Prices of cryptocurrencies are influenced by many factors such as innovation or invention in technology and news about regulations.

Advanced Strategies

Advanced margin trading strategies are commonly applied by experienced traders in crypto. They include:

- Hedging: This is a technique where positions are opened in opposite directions to reduce risks. An example is when you have a long position on Bitcoin and open a short position on another digital currency to counteract possible losses.

- Technical Analysis: Technical analysis can be done using moving averages, relative strength index (RSI), and moving average convergence divergence (MACD). Market trends are depicted by these tools that enable one to make well-informed decisions regarding trading.

- Risk-Reward Ratio: An evaluation of the risk-reward ratio must be made before a position is opened. A good risk-reward ratio ensures that likely gains are more than potential losses, thus making engaging in such a trade sensible.

- Scalping: Scalping exploits minor price changes by entering into many small trades. This method demands quick thinking to take advantage of small-time investment opportunities and a good eye on the market situation.

- Swing Trading: Swing trading involves holding positions for several days or weeks to benefit from expected price swings. This strategy requires patience as well as being able to recognize different stages in a market cycle.

Best Practices for Margin Trading Crypto

Here are some best practices to help traders maximize their potential with margin trading, apart from risk management strategies:

- Thorough Research: It is important not only to know the principles of working with leverage in trading but also to know the characteristics of a particular cryptocurrency being traded. The more you read about it, the better your choices will be.

- Risk Management Tools: You should use all available risk management tools on your trading platforms. These include; risk calculators, profit/loss calculators, as well as real-time notifications that could enhance trade management.

- Diversification: Diversification can become more difficult when using margin, but it is essential to avoid over-concentrating on a single asset. Having a diversified portfolio will be less risky and highly returnable.

- Continuous Learning: Margin trading is a skill that can always be improved. Join webinars, and enroll for courses and other learning platforms to enhance the quality of your trading strategies.

- Emotional Control: Trading can lead to stress, especially with margin trading as it adds extra risk to the trader’s account. It is important to have control over your emotions so that you can stick to your trading plan without getting carried away by market panic.

Elevate Your Trading Game: Margin Trading Simplified with All in One Crypto

The All in One Crypto app is the perfect tool for traders interested in margin trading. Our platform simplifies the complexities of trading on margin, providing users with powerful insights and real-time data that are essential for making the right decisions.

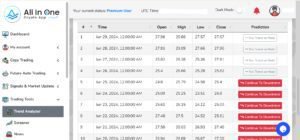

Our Trend Analyzer tool is specifically designed to simplify the identification of market trends. This tool helps in navigating the uncertainties of the crypto market, providing users with clear, actionable insights that help in making informed decisions. By understanding and using these trends, traders can not only survive but also thrive in challenging market conditions.

Try it out at 👇

https://dashboard.allinonecrypto.app/coin/trend-analyzer

To safeguard our users, we offer various risk management tools and educational resources that help in understanding the potential pitfalls and strategies to prevent them. The All In One Crypto app invites traders to explore our Knowledge Center, packed with resources like eBooks and PDFs. These materials are designed to enhance your understanding of both technical and fundamental analysis, crucial for successful margin trading. Refine your trading skills and strategies, ensuring you make well-informed decisions.

To try it out 👇

https://dashboard.allinonecrypto.app/dashboard/knowledge-center

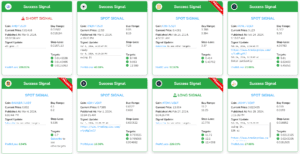

We also encourage users to explore our Altcoin/Futures section, where we offer free trading signals. These resources are designed to equip you with effective trading strategies, enhancing your understanding and confidence in the crypto market.

To try it out 👇

https://dashboard.allinonecrypto.app/coin/altcoin

Are you ready to take your trading to the next level? Download the All in One Crypto app today and discover the power of efficient, informed, and strategic margin trading. Join our growing community of savvy traders who are already maximizing their market potential. Start trading smarter, not harder, with All in One Crypto.

Conclusion

Although there is a chance to make more money with crypto margin trading, there are also greater hazards. Anyone who wishes to engage in this type of trading must understand what margin trading is, the risks associated with leverage in cryptocurrency, and how to use efficient risk management techniques. This is only made possible by being aware of the top resources and applications that can raise their chances of success in this particular trade line.

Frequently Asked Questions

- What does margin trading in cryptocurrency mean?

Margin trading in cryptocurrency refers to the process of borrowing money to increase the size of a position and trade more assets than funded. Through this method, traders can utilize their positions which may result in increased gains though it also raises the possibility of huge losses.

- How is margin trading crypto different from ordinary trading?

Regular investment is done using your personal funds while during margin trading, you can take loans from brokers which allow you to trade with larger amounts. With this method, the initial amount acts as security against which profits or losses can be multiplied by the borrowing power used.

- What are the risks in crypto margin trading?

Risks in the crypto margin trade feature high market volatility causing sudden and huge losses, being liquidated when the market moves against you, and paying interest accruing on borrowed funds which can diminish your profits.

- Can you explain crypto leverage and margin trading?

Crypto leverage enables traders to magnify their market exposure without making substantial upfront investments. While in margin trading this is attained through using borrowed capital to increase potential gains from cryptocurrency price swings; however, it also escalates potential losses.

- What strategies should I consider to manage risks in margin trading crypto?

Effective strategies for managing risks include setting clear stop-loss orders to limit potential losses, maintaining adequate margin levels to prevent liquidation, monitoring interest rates on borrowed funds, and staying informed about market conditions that can affect cryptocurrency prices.