The cryptocurrency market is known for its volatility which means it presents lots of opportunities but one must go ahead with caution. There are reliable tools that traders can use to stay ahead of market trends and make profitable decisions. Binance trading signals have become essential tools for anyone who hopes to thrive in this rapid environment. This could be achieved by giving signals timely and accurately empowering the traders to maximize their potential returns while minimizing risks involved. In this guide, we will discuss what Binance signals are as well as their advantages and how they are used today, with references to the latest trends and future opportunities.

Understanding Binance Trading Signals

1. What Are Binance Trading Signals?

Binance’s trading indicators are specific alerts or pieces of advice that show the right time when to buy or sell particular cryptocurrencies. These signals come from the combination of technical analysis, market trends, and insider knowledge sometimes. These signals are meant to guide traders to make informed decisions in very volatile markets where prices can change drastically within a short period.

2. Types of Binance Trading Signals

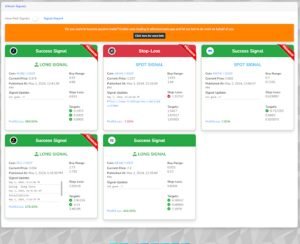

- Spot Market Signals: These signals help traders buy and sell cryptocurrencies at the current market rate. Spot market signals focus on maximizing immediate profit.

- Future Trading Signals: These signals are more strategic, providing insights into how to position trades for potential future movements in the market. Future trading signals can be more complex but offer high rewards when used effectively.

Why Use Binance Trading Signals?

- Maximizing Profits: The primary objective of any trader is to obtain large profits. Using Binance trading signals gives traders a prompt about market trends and entry/exit points. They can then be able to make good money by trading at the time when a chance for profit arises.

- Risk Management: A volatile market carries inherent risks. Binance signals provide insights that can help traders limit potential losses. By receiving alerts when the market is likely to turn, traders can adjust their strategies to prevent significant financial setbacks.

- Time-Efficiency: Manually analyzing charts and market data takes considerable time and effort. Binance signals streamline this process by offering ready-to-use advice. This allows traders to focus on executing trades rather than spending hours researching market movements.

- Diversification of Trades: This feature allows traders to trade in many different resources on Binance signals. When they receive alerts from many markets as well as coins being traded, it helps them to spread their risks and also avoid putting too much emphasis on one particular asset.

Identifying the Best Binance Signals

Many trading signal providers are available and choosing the best Binance Signals may be difficult. These are some things one should take into account when selecting a provider:

- Transparency: The best Binance signals come from providers who are transparent about their strategies. They provide clear information on how signals are generated, which enhances trader confidence.

- Accuracy: A high success rate is crucial. The best signal providers boast a significant percentage of successful trades, often providing historical data to prove their effectiveness.

- Support: Support services are crucial for new and experienced traders. Good signal providers offer customer support to help traders interpret and act on signals.

- Pricing: While many signal providers charge fees for their services, free binance trade signals are also available. It’s essential to balance affordability with the quality of advice.

For the Binance Crypto Trading Signals, you must check out All In One Crypto which offers AI Trend Prediction of Binance Cryptocurrencies and more. they are one of the best providers offering both Free and Premium Channels and more!

How to Use Binance Signals for Success

- Develop a Strategy: Even the most accurate signals require a solid trading strategy. Develop a structured plan of buying and selling using your understanding and Binance signals.

- Keep Emotions in Check: Emotions can be stirred up by markets leading to rash choices. Stick to reasoning based on data by utilizing Binance signals, thus reducing the chances of making emotional trades.

- Stay Updated: Market trends are constantly evolving. Ensure you receive updates from your signal provider, and use them in tandem with your analysis for well-rounded decisions.

- Monitor Results: Always evaluate your trading progress periodically to know whether or not your chosen Binance signals are working well for you. Depending on what has worked or otherwise, make modifications to your strategy as needed.

Exploring Future Trading Signals

Future trading signals offer insights into potential market movements, helping traders position themselves effectively. These signals can be particularly advantageous for:

- Leveraged trading: In the case of future trade, traders can leverage their positions to potentially amplify gains. On the other hand, they also have a higher risk and therefore position them with care based on future trade signals.

- Hedging: Traders can use futures to hedge against unfavorable price movements. Future trading signals provide the necessary data to mitigate losses and lock in profits.

- Predictive Analysis: By analyzing historical data and patterns, future trading signals predict where the market is likely headed. This allows traders to anticipate significant shifts and prepare accordingly.

Finding Quality Providers of Binance Trading Signals

Identifying a reliable source of trading signals is essential for success. The following are some steps to find trustworthy providers:

- Research Reviews and Recommendations

User reviews can offer insights into the credibility of a signal provider. Social media forums, financial blogs, and dedicated trading communities often share valuable recommendations.

- Test Free Signals

Some providers offer trial periods or free binance trade signals. This allows you to test the quality of their insights before committing to a paid plan. Use these trials to understand the accuracy and relevance of their signals to your trading style.

- Evaluate Signal Delivery

Timely delivery is crucial in the rapidly shifting crypto market. Make sure the provider uses reliable channels like email, mobile apps, or instant messaging apps to deliver alerts promptly.

- Assess Analytical Tools

Providers that offer analytical tools alongside their signals can enhance your trading experience. These tools help interpret signals, giving you deeper insights into market trends.

Common Challenges with Binance Trading Signals

Despite their advantages, using Binance signals can present challenges. Here’s how to handle them effectively:

- Over-Reliance on Signals: While useful, traders should not only depend on signals. Use signals as a part of a wider strategy that incorporates personal research and market analysis.

- Timing Issues: Sometimes signals might arrive too late due to technical issues or rapid market changes. Therefore, always verify signals and be ready to act swiftly.

- Risk of Scam Providers: Unfortunately, not all signal providers are legitimate. Exercise caution when choosing a provider, especially if they make unrealistic promises.

- Market Volatility: Even the best binance signals may struggle with unprecedented market volatility. Having a solid risk management plan ensures you’re prepared for sudden shifts.

Maximizing Gains with Advanced Strategies

Advanced strategies can further boost your profits when used alongside Binance trading signals. Consider these approaches:

- Automated Trading

An automated trading bot acts upon Binance indicators instantly. Trading bots eliminate emotions from trading and enable multiple strategies to be operated simultaneously, thus enhancing efficiency.

- Stop-Loss and Take-Profit Orders

Include signals with stop-loss and take-profit orders to safeguard your investments. Selling at a predetermined price so that losses can be avoided is what stop-loss orders do whereas take-profit orders are meant to secure gains.

- Diversified Portfolios

Diversify across different cryptocurrencies to mitigate risks. Binance signals help identify promising trades across a broad range of crypto pairs.

- Staking and Yield Farming

Consider staking or yield farming in addition to trading. While signals guide your short-term trades, these strategies offer steady, passive income.

Emerging Trends in Binance Signals

The cryptocurrency landscape is constantly evolving. Here are some trends that will shape the future of trading signals:

- Artificial Intelligence (AI)

Signals identified by AI have enough data that help analysts make accurate predictions, which are mostly precise. More providers should be expected to integrate AI for more advanced analysis.

- Social Trading Signals

Social trading signals leverage the wisdom of the crowd by analyzing successful traders’ behavior. Users can replicate top traders’ strategies directly.

- Subscription-Based Models

More providers are moving toward subscription-based models, offering tiered plans based on trader experience and needs.

- Customized Signals

Due to the evolving needs of traders, providers have started customizing their signals based on specific trading strategies and risk appetites.

Conclusion

Keeping up with the fast cryptocurrency trading world calls for a mix of strategy, timing, and data. These Binance trading signals provide real-time and actionable insights that help traders to maximize profits and reduce risks. Whether you are concentrating on spot markets future trading or both, these signals can be customized to suit your style and objectives as a trader. Selecting good finance signals can give you the confidence needed to tackle market challenges and take advantage of its several opportunities.

If you are new in crypto or have been here for years and want some surefire strategies that work then add Binance Signals to your toolbox. Their ability to offer up-to-the-minute insightful guidance makes it possible for you to develop realistic strategies to stay ahead in a volatile cryptocurrency market.

Frequently Asked Questions

- What are Binance trading signals, and how can they help me trade better?

Binance trading signals are trading recommendations derived from technical analysis and market trends that advise you on the best times to buy or sell specific cryptocurrencies. They guide traders in making choices and profiting from any advantages while saving them from risks.

- Are there free Binance trade signals available, or do I need to pay for them?

Free Binance trade signals are available through some providers offering trial versions or complimentary alerts. However, paid services often provide more in-depth analysis and features that can enhance trading strategies.

- How do I choose the best Binance signals provider?

To find the best Binance signals provider, look for transparency, a proven success rate, strong customer support, and clear signal delivery methods. User reviews and trial periods can also help you assess a provider’s reliability.

- How do future trading signals differ from regular Binance signals?

Future trading signals focus on predicting potential future market trends, helping traders strategically position themselves for future gains. They are often used in leveraged trading, hedging, and predictive analysis, while regular signals focus on immediate market opportunities.

- Can Binance trading signals guarantee profits in cryptocurrency trading?

No, there is no assurance of making money as long as the conditions for cryptocurrency markets remain uncertain; however, these are useful tools for traders’ strategies that provide information necessary for decision-making. Traders should still conduct personal research and apply risk management.