The allure of cryptocurrency trading bots lies in their promise to automate complex trading strategies, potentially increasing profitability without requiring constant market monitoring. While these bots can indeed be a powerful asset in a trader’s arsenal, navigating the automated trading landscape requires a nuanced understanding to avoid pitfalls that could undermine your trading performance.

Not Understanding How Cryptocurrency Trading Bots Work

A fundamental grasp of how cryptocurrency trading bots function is crucial before incorporating them into your trading strategy. These bots operate by analyzing market data and executing trades based on predefined criteria. Without a clear understanding of these mechanisms, traders may find themselves at the mercy of algorithms they do not fully comprehend, leading to less-than-optimal trading outcomes.

Over Reliance on Bots

The convenience of trading bots can sometimes lead traders to overly depend on them for all trading decisions. It’s important to remember the value of human oversight. Market conditions are dynamic, and the ability to adjust strategies in response to these changes is something bots may not always manage effectively on their own.

Ignoring the Need for Testing

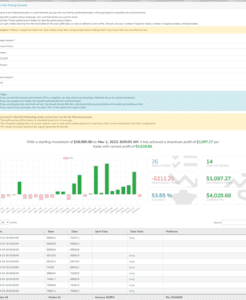

Backtesting your trading strategies with historical data is a step that should never be skipped. This process allows you to ensure your strategies are viable and make necessary adjustments before applying them in live trading scenarios. Neglecting this step could result in deploying a strategy that is doomed from the start.

At All In One Crypto App, we provide a simulator to check out coins performance with simulated results so that you can decide the perfect coin that our AI Crypto Trading bot can trade for you.

Failing to Consider Fees

Trading fees can quickly erode profits, especially in high-frequency trading scenarios common with bot use. Accounting for these fees when setting up your bot strategies is essential to ensure that your trading remains profitable.

Neglecting Security Practices

The digital nature of cryptocurrency trading makes security a paramount concern. Protecting your trading bots and associated accounts from unauthorized access is critical. Employ strong passwords, use two-factor authentication, and be cautious about sharing API keys.

Using Poorly Configured Bots

The risks associated with using bots that are not properly configured to match your trading goals and risk tolerance cannot be overstated. A poorly configured bot can lead to significant financial losses, particularly in the unpredictable cryptocurrency market.

Chasing Losses with Bots

Attempting to use bots to recover from losses through aggressive trading tactics is a perilous strategy that can lead to compounded financial damage. It’s crucial to maintain a disciplined approach and not let emotions drive bot trading decisions.

Failing to Update the Bot

The cryptocurrency market is in constant flux, necessitating regular updates to your bot’s software and trading parameters. Keeping your bot aligned with current market dynamics is essential for maintaining its trading effectiveness.

Best Practices and Recommendations

To navigate the world of cryptocurrency trading bots successfully, it’s recommended to invest time in learning about their operation, start with demo trading to test strategies without financial risk, and select bots with strong community support and transparent performance records.

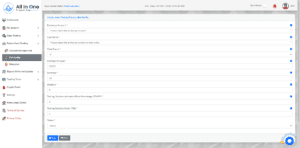

Auto Trading Features of All In One Crypto App

The All In One Crypto App stands out by offering specific tools, resources, and services that cater directly to the needs addressed in this article. Its auto trading feature is designed with user-friendliness in mind, ensuring traders can easily configure bots to align with their trading strategies and risk tolerance. This approach not only enhances the trading experience but also reinforces the importance of understanding and directly engaging with the automated trading process.