Sorting through potential trades fast and efficiently is essential in the rapidly evolving world of cryptocurrency trading. For traders looking to profit from market swings, using a cryptocurrency pair screener is essential. We’ll look at several techniques in this article to use a crypto screener efficiently, which can significantly enhance your trading tactics and investing outcomes.

What are Crypto Pair Screeners?

A digital tool that is able to filter through a lot of cryptocurrency pairs and to do it based on certain parameters like price movements, market cap, volume, and lots more is referred to as a Crypto Pairs Screener. It works in a similar manner as stock screeners but it has been customized for the crypto market which is quite dynamic. To use it effectively, you must first understand what crypto pairings are and also comprehend their significance.

Crypto pairs consist of two different cryptocurrencies BTC/ETH where Bitcoin (BTC) is traded against Ethereum (ETH). The performance of these pairs can provide deeper insights into market dynamics and relative strength between cryptocurrencies.

Selecting the Right Crypto Pairs Screener

There are several things to consider when selecting the perfect crypto pairs screener. The best crypto pairs screener offers real-time data, a variety of filters and can seamlessly integrate with trading platforms. Also, one can customize and save their screener settings for future use.

Real-time Data: The importance of real-time data cannot be emphasized more especially in a very unpredictable market like crypto where even a small piece of information can make or break your trade.

Extensive Filtering Options: A good screener should provide various filtering options including price change percentage, volume, market cap, and technical indicators like moving averages or RSI levels.

Integration and Customization: The most effective screeners enable users to merge with trading platforms hence making them act quickly on their findings. These customization alternatives allow users to adapt the screener according to their particular trading strategy.

Strategies for Using a Crypto Screener

Using a crypto scanner for traders effectively involves more than just running searches; it requires strategic thinking and a clear understanding of market indicators.

- Define Your Objectives: Before using any screener, clearly define what you are looking for in the market. Are you seeking short-term gains, or are you more interested in long-term investments? This will guide the parameters you set in your screener.

- Utilize Technical Indicators: To find possible buy/sell signals, use such technical indicators as MACD, RSI, and Bollinger Bands as a part of the screening criteria. One can automate these analyses using an AI Crypto Screener that uses sophisticated algorithms to predict market moves more accurately.

- Watch Market Trends: Monitor the larger market trends through your screener. This could mean tracking top-performing crypto pairs or finding underperformers for possible opportunities.

- Keep Updating and Regular Adjustments: The world of cryptocurrencies is highly volatile due to global macroeconomic factors as well as crypto-specific news affecting the scene. Ensure that you update and adjust your screener settings regularly to keep up with current market conditions.

Advanced Techniques

Advanced strategies can offer deeper insights and potentially more profitable opportunities for those who have mastered basic screening techniques.

- Cross-Market Analysis: Cryptocurrencies across different exchanges are compared to identify arbitrage opportunities. This involves buying one pair at a cheap rate on an exchange and selling it at a high price on another.

- Sentiment Analysis: Merging market sentiment into your analysis makes it competitive. The idea behind this is to assess how perception in the market towards certain crypto pairs may impact their future performance.

- Backtesting: Testing the past performance of your screening strategies using historical data is called backtesting. Such an approach can help streamline your operations before testing them out under real market conditions.

Tips for Maximizing the Use of Crypto Screeners

To maximize your crypto pairs scanner, take note of the following:

- Stay Informed: Stay current with the latest news and happenings in the cryptocurrency market. Changes regarding regulations, technology developments, or even changes in moods within the market can affect how cryptocurrency pairings perform.

- Vary Your Criteria: Do not depend on a single criterion. Try out various filters and indicators to see which ones work best with your trading style and objectives.

- Acquire the habit of patience and discipline: Success in trading depends on how patient you are. Stick to predefined criteria and don’t make rash decisions based on short-term market fluctuations.

- Use Multiple Screeners: Different screeners may contain features. Using a variety of screeners can give one a better perspective of the markets which will allow identify where the best opportunities lay.

- Never Stop Learning: The crypto market is always changing, and so should your learning and strategies. Keep curiosity alive by constantly educating oneself about new tools, indicators, techniques, etc.

Using AI for Enhanced Trading Insights

Modern crypto screeners heavily depend on artificial intelligence (AI). Human traders, unlike AI technologies, cannot analyze large data volumes at the same speeds. The feature of the AI Crypto Screener makes this possible and is beneficial for predicting trends in the market before they occur

Benefits of AI in Crypto Screening

- Predictive Analytics: For example, historical data patterns and correlations that may be invisible to an individual’s eye can be pointed out by the AI.

- Pattern Recognition: Market trends and anomalies are better observed with machine learning algorithms, thereby enabling us to make more precise decisions.

- Automated Adjustments: AI can adjust its screening criteria when market conditions change ensuring it remains relevant and useful.

- Speed and Efficiency: Artificial Intelligence can process huge data quantities within a blink of an eye allowing faster decision-making.

- Accuracy: AI algorithm reduces human error hence giving more accurate analysis and insights.

- Complete Analysis: AI has the capacity to analyze several sources of information at once offering a holistic market perspective.

- Risk Management: AI models can predict potential risks and provide methods of managing them.

- Customized Screening: Parameters for screening can be personalized using artificial intelligence based on an individual trader’s preferences and objectives.

- Adaptive Learning: Artificial Intelligence systems are capable of learning from users’ habits and updating their own lists of selection criteria as well as recommendations.

- Fraud Detection: AI is able to identify abnormal trends or activities that might lead to fraud hence safeguarding markets.

Best Practices for Using Crypto Pair Screeners

To boost the effectiveness of a crypto pair screener, there are a few best practices that traders can think about.

- Frequently Update Screening Criteria: The market conditions for cryptocurrency trading keep on changing. Strategies that work today, may not be efficient tomorrow. Regularly updating the criteria applied in the crypto asset screener helps to adapt to new market realities and optimize trading strategies.

- Utilize Extensive Filters: Although basic filters like price and volume can be used, incorporating advanced ones like moving averages, and RSI levels among other technical indicators will give more insight into market trends and refine your trade-offs.

- Strategies Backtesting: The most advanced screeners offer an option of testing strategies by looking into historical data. It is very important as it enables traders to realize how effective their plan is without using real capital.

- Incorporate Broader Market Analysis with Screener Insights: Though screeners offer helpful, data-driven insights, a more holistic market view can be obtained if these insights are integrated with a wider market analysis that includes economic indicators and global events.

Trade Smart with Advanced Screening Tools on All in One Crypto App

The All in One Crypto app is an exceptional resource for traders looking to streamline their crypto pair selection process.

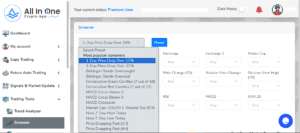

Our crypto screener tool scans the crypto market to identify coins that meet specific preset conditions such as MACD bullish crossovers, Bollinger Bands, or EMA interaction with candles. This targeted approach not only saves time but also enhances trading strategies by focusing on assets that match specific technical setups.

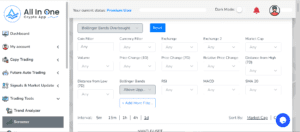

The screener offers a wide range of preset filters, such as 1-day price drops over 20% or 10%, Bollinger Bands indicating overbought or oversold conditions, and patterns like consecutive green or red candles. Additional customization is possible with filters for currency type, exchange, market cap, and price changes over 1 and 7 days, ranging from 1% to ±20%. Advanced filters like RSI, Bollinger Bands, and MACD allow for more precise targeting, ensuring traders can quickly identify the most promising opportunities according to their trading strategies.

Using this screener helps traders quickly identify the best opportunities without having to manually check each cryptocurrency. It’s like having a smart assistant that points out the best options based on your chosen criteria. This makes it much simpler for both beginners and experienced traders to select the right crypto pairs, ensuring they make more informed and potentially profitable trading decisions.

By providing real-time data and precise filtering capabilities, the All in One Crypto app allows traders to make smarter decisions, optimize their strategies, and increase the likelihood of successful outcomes in the volatile crypto market.

Check out the tool here 👇

https://dashboard.allinonecrypto.app/dashboard/screener

Future Trends in Crypto Screening Technology

With the advancement in technology in cryptocurrency screening tools, it is expected that crypto screeners will continue to improve their quality. Here are some future trends to watch out for:

- AI and Machine Learning: The integration of AI and machine learning into crypto screeners is already underway. These technologies can analyze vast amounts of data quickly and identify patterns that may not be immediately apparent to human traders. AI Crypto Screeners will likely become more prevalent, providing even more accurate predictions and insights.

- Enhanced User Interfaces: Future screeners may feature more intuitive and user-friendly interfaces, making it easier for traders of all experience levels to use them effectively. Visualization tools and interactive dashboards could further simplify the screening process.

- Blockchain Integration: Decentralized exchanges as well as blockchain networks can be directly integrated into screening devices as blockchain technology keeps on advancing. In turn, the enhanced capability helps to provide real-time input and increased transparency, which in turn ensures that the data provided is more accurate and reliable.

- Social Trading Features: Again screeners could include social trading elements where sharing of screening criteria, strategies, and results are shared within a community. Consequently, this developmental approach has led to learning from one another among traders thus making them improve their skills.

- Regulatory Compliance Tools: Screeners may also offer tools for meeting regulatory requirements as rules on cryptocurrencies evolve. By so doing these could ensure that trade takes place legitimately and ethically.

Conclusion

To navigate the volatile crypto market, traders and investors must learn how to use a good crypto pairs screener. They can help you take advantage of any potential in it whether you are using a crypto scanner for traders or AI Crypto Screener. By understanding the characteristics, employing strategic filtration, and adapting to market changes on an ongoing basis, your trading performance will be improved upon and more informed investment decisions will be made.

Keep refining your approach; stay curious, embrace these strategies; stay ahead in the dynamic world of cryptocurrency trading. You’ll have a new sense of opportunities for financial goal achievements within the emerging crypto market if you think right and have appropriate tools.

Frequently Asked Questions

1.What is a crypto pair screener?

A crypto pair screener; assists traders in refining cryptocurrency pairs according to specific criteria such as price action, volumes, and technical indicators thus improving on targeting of trading opportunities.

2.How does an AI Crypto Screener enhance trading?

AI Crypto Screener utilizes artificial intelligence to study huge data amounts and predict the trends in the market so that it can give information for the anticipation of market movements leading to making more informed decisions during trade.

3. What are the top features to look for in a crypto pairs screener?

Real-time data updates, customized filters, AI-guided analysis, and notifications on significant shifts in the market are among the top features of the crypto pairs screener.

4. Can a crypto scanner for traders help in risk management?

Yes, a crypto scanner for traders can significantly aid in risk management by allowing traders to set parameters that filter out high-volatility crypto pairs or identify stable assets, thus helping in making safer investment choices.

5. How is the crypto asset screener different from other screening tools?

Different from other screening tools, a crypto asset screener is specifically dedicated to cryptocurrencies and thus provides customized metrics and filters suitable for crypto assets, unlike general financial screeners which may not offer features specific to cryptocurrency markets’ intricacies.