Crypto market leverage trading is a powerful trading instrument that allows traders to extend their market exposure beyond the initial investment by lending. Such a method has the potential to increase returns on small price fluctuations in cryptocurrencies. However, there are increased risks as well, thus making it crucial for traders especially beginners to understand how it works before they venture into it.

What is Leverage Trading in Crypto Market

Leverage trading in crypto market involves using money borrowed from someone else to make higher returns on investments. With cryptocurrencies, this means that a trader can commit less capital and still have a larger position. For instance, if somebody uses 10x leverage, they can open a ten times bigger deal than the sum initially invested by them.

In the crypto market, leverage trading enables maximum profit generation with low starting capital. This allows investors to enter into larger positions and profit even from small price changes. However, on the contrary, such gains can also multiply losses which may even go beyond the initial capital.

How Leverage Trading Works in the Crypto Market

- Choosing a Platform: To start leveraging in crypto markets, the first step is to choose an ideal platform. Several exchanges offer leverage trading but the best crypto leverage trading platform will have a user-friendly interface, high liquidity, and strong security protocols. Crypto exchanges that offer leverage trading provide traders with enough money to reach their desired position size.

- Margin Requirement: Traders who want to initiate a leveraged trade must deposit an initial margin which stands as a percentage of the total trade size. This margin acts as collateral for the borrowed funds.

- Leverage Ratio: The traders can always select their ratio of leverage, which specifies how big the trade or deal would be to the margin. Common ratios range from 2x to 100x.

- Opening a Position: Once the Margin and leverage ratio are set, can traders take short or long positions. A long bet bets on the prices increase, while a short bet says that prices decline.

- Monitoring the Trade: Due to increased risks, the trade must be monitored closely. Traders can manage their positions by using tools like leverage trading crypto calculator which calculates potential losses and profits.

- Closing the Position: Anytime they choose to, traders can close their positions to realize their profits or losses. If the market moves favorably towards one’s direction as a trader; they tend to make higher returns on their initial margin. On the other hand, if prices move against them; it leads to large losses that may go beyond their deposit amount which then prompts a margin call. Under such circumstances, you must either top up your account or close your position to cover these losses.

Advantages of Leverage Trading

- Increased Exposure: leverage trading offers a way through which the traders can get more market exposure using little capital, maybe resulting in greater profits.

- Diversification: This enables the traders to spread risks across different assets due to having more funds at their disposal.

- For All Levels of Expertise: Leverage trading in crypto for beginners and experts has options that let you go short or long on a position and therefore create profit opportunities in both rising and falling markets.

Risks of Leverage Trading

- More losses: While leverage can blow up gains, it can also blow up losses. In the event that the market moves against traders, they may lose more money than they initially invested.

- Margin Calls and Liquidation: When the market moves adversely for leveraged positions, traders may face margin calls or forced liquidation causing significant losses.

- Market Volatility: The crypto market is famous for its high volatility which makes prices swing rapidly and unexpectedly, thus raising risks of leveraged interests.

Choosing the Best Crypto Leverage Trading Platform

When it comes to a successful trading experience, one needs to choose the right platform for crypto leverage trading. In addition to high-leverage options, an ideal platform should also have strong trading tools, deep liquidity as well as security in the market, and good customer support service. The All In One Crypto app provides educational information that helps traders who are new in this area of trading to understand leverage better. Key features include:

- Security: The platform has strong security measures to protect consumers’ money and personal information.

- Liquidity: When it comes to liquidity, High liquidity ensures that the traders can enter and exit positions without much price slippage.

- User Interface: A friendly user interface with advanced trade tools that can improve the trading experience.

- Reputation: Our platform’s reputation is well-researched by traders through user ratings and industry reviews that guarantee its dependability and trustworthiness.

Leverage Trading Crypto Calculator

Any trader who engages in leverage trading needs to have a crypto calculator for leverage trading. It assists in calculating potential loss or gain before taking a position. If traders enter input on entry and exit prices, amount of capital, and leverage ratio, they can gain insight into their trade’s possible results such as the necessary margin as well as the point at which there will be a margin call. Without this tool, planning trade and understanding its risks is difficult.

Leverage Trading Strategies for Beginners

Starting with leverage trading in crypto market for beginners can be intimidating, but these strategies help to reduce risks.

- Educate yourself: Basic education on cryptocurrencies and how leverage trading works is important for beginners. Newcomers need to understand the meaning of leveraging as well as the consequences involved in this type of investment.

- Begin small: Beginners are advised to begin with low leverages so that they get used to the swings and dynamics associated with leveraged trading.

- Take advantage of stop loss orders: Stop loss orders should be used by beginners to manage risk properly. Such orders are automatically executed when a particular price level is hit thereby limiting losses that may be incurred.

- Monitor Trades Actively: Leverage trading requires constant market monitoring as crypto markets are highly volatile. Sudden price changes can significantly impact leveraged positions.

- Practice Risk Management: Never risk more than a small percentage of your trading capital on a single trade.

- Be disciplined: Emotional trading may lead to poor choices. Stick to your trading plan and avoid impulse.

- Keep reviewing your strategy: Market situations change, and what works today might fail tomorrow. Review regularly and adjust your trade strategies based on performance as well as market analysis.

- Understand Fees: This often comes with additional costs of high trading fees and interest charges for borrowed funds. Know about these expenses and include them in your trading considerations.

Start Trading Smart: Explore What All In One Crypto App Has to Offer

The All In One Crypto app is a treasure trove for beginners, featuring a comprehensive Knowledge Center packed with valuable content for beginners to kickstart their trading journey.

To try it out 👇

https://dashboard.allinonecrypto.app/dashboard/knowledge-center

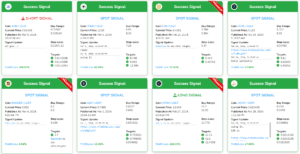

We also encourage users to explore our Altcoin/Futures section, where we offer free leverage trading signals. These resources are designed to equip you with effective leverage trading strategies, enhancing your understanding and confidence in navigating the crypto market.

To try it out 👇

https://dashboard.allinonecrypto.app/coin/altcoin

Check out our platform to discover practical tips and market insights that will elevate your trading skills and portfolio performance.

Conclusion

The crypto market has a very large potential for profit. This is the reason why traders can use and magnify their winnings which arise from the change in price of cryptocurrencies. However, with greater profit opportunities comes greater risks. Thus, both professional and new traders need to have a proper knowledge of how leverage trading works and also employ effective risk management methods when dealing with it. Therefore, by using the best platform for leveraging crypto-trading and taking advantage of a leveraged trading calculator at your disposal as a trader you can be able to successfully sail through complexity in leverage trading and enhance your trading results.

Frequently Asked Questions

- What does leverage trading mean in the crypto market?

The meaning of leverage trading in crypto market is that traders can increase their trading position more than they could have done by their own money alone. Such an approach makes it possible to multiply small gains but also intensifies the risk of greater losses.

- How do I start with Leverage trading in crypto for beginners?

For beginners, it’s necessary to select a good trading platform that provides a leverage capability. One should get himself/herself acquainted with the process and its associated dangers as well. The use of lower leveraging ratios at the beginning plus using stop loss orders can help reduce potential losses.

- Which platforms are considered the best crypto leverage trading platforms?

The most recommended platforms for crypto leverage trading offer tight security protocols, a good user interface, and advanced tools for trading. Still, they should avail educational resources to help newbies comprehend the intricacies of leveraging trade.

- How can a leverage trading crypto calculator help traders?

In simple terms, it can help traders determine how much money they will make or lose if they enter into a trade. It takes into account the required margin, potential profit, and loss depending on conditions set by the trader such as leverage, entry price, and exit prices.

- What is the main thing to concentrate on as a beginner in leveraged trading and Crypto?

Beginners should focus on getting acquainted with market movements specific to leveraged trades including understanding risks. Such actions like planning carefully with caution for risk management purposes and starting with low leverage levels by using stop-loss orders can protect investments.